I have had several transactions since the (new) lending changes took effect in 2014. Unfortunately the sentiment from almost all of my buyers is frustration with lenders.

I’ve spoken with one of our local lenders, Cathy Starrett at Stearns Lending asking what I can do to better serve my buyers and prepare them for the roller coaster process that financing real estate seems to be. Cathy had some good tips and I wanted to elaborate here.

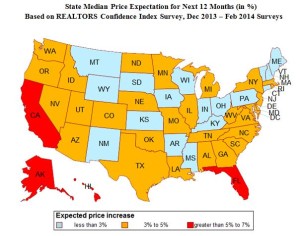

– Buyer Confidence and Trust It seems that buyers and lenders have both lost the human element of trust with downturn in our real estate market. Buyers seem to have lost trust in Realtors, appraisers and financial institutions. It is understandable with home values that have literally been on a landslide for the past few years. However, it appears that the tide has shifted. “REALTORS® generally expect prices to increase over the next 12 months at a modest pace with the median expected price increase at 3.9 percent, according to the latest REALTORS® Confidence Index. Demand has slowed somewhat because of the increase in home values and the cost of borrowing from higher mortgage rates and mortgage insurance premiums for FHA loans. The modest pace of economic growth has also kept the lid on price growth.” -National Association of Realtors

Of course, the other side of the coin is lender trust. Lenders have also lost trust in home owners. With the high rate of foreclosure during the downturn, lenders went from very lenient guidelines to very strict ones. We are now starting to see the balancing of the scales, and qualified buyers are able to get financing at very favorable rates.

– Confusion and Miscommunication There are so many sales pitches for buyers. Many are unsure where to even start. Should the search begin with looking at homes? Talking to a Realtor? Talking to a mortgage lender? Stalk sites like Zillow, Trulia? My answer is contact both a Realtor and a mortgage lender early on. Most of the time a buyer will have to have a pre-qualification or pre-approval letter from their lender to even submit an offer. It also doesn’t serve anyone for a buyer to be looking at homes they can’t qualify for. Cathy says “When looking for a mortgage, you don’t have to apply to ask questions. And no question is silly…after all, how many times will you be purchasing a house? Get the facts!! Find out if the lender is focused on you…or the loan. Does the lender have your best interest at heart? A good lender will listen to you and can give you advice to move you closer to your goals and secure a loan that is suited to your needs.” Also, be wary of some advertised rates. While the rate may be very appealing, there could also be hidden fees or discount points (cost of the rate) that aren’t apparent at first glance. Find out what the true cost of a loan is before applying. Ask your lender for a Good Faith Estimate (GFE).

– Finding the RIGHT lender Start by asking someone that may have recently purchased a home. Ask your Realtor, call your financial adviser, get referrals. Then CALL these people. The person you’ll be working with is human, and different personalities work better with certain people. You’ll want to take a few minutes to have a lender answer your questions. If you feel comfortable talking to this person and you like the rates you’re being quoted, then chances are you’ve found a good “fit” and can look forward to a pretty good experience. Take control of your loan by talking with a live loan officer who can give you answers.

– Don’t get frustrated It may seem that the lender needs to know everything about you for the application. Actually all the lender needs to know about is:

- Can you afford the loan

- Do you qualify for a particular program?

- Do you have the ability to repay?

The ability to repay the loan will include your credit report (score and proof of paying your liabilities on time) and your stability of income. You will, however, need to provide quite a lot of details (read: paperwork) about these topics. The goal with fitting a loan program to your needs is to avoid financial hardships. This is the lender’s way of ensuring they are not risking losing money on a home that a buyer can not pay for, as well as keeping a borrower from stretching too thin while they repay the loan. I know you’ve heard it time and time again: Check your credit score! Know what your numbers are, or if you have some clouds on your report that need cleaned up before a lender can help you purchase a home. One of the best websites for obtaining a free, annual, credit score is to go to www.annualcreditreport.com. This website will give you all three credit bureau scores. Most other sites will only give you one score. Lenders usually get all three scores and will use the middle score.

– Your Realtor and Lender It is also important for the two to communicate. Both your Realtor and Lender need to keep each other updated and when you find that symbiotic relationship, it makes the transaction so much easier for a buyer. Ask your lender about communicating with your Realtor.

Ultimately, the lender is trying to help you as much as your Realtor. There are times when it seems like a lender is obsessing over every minute detail of your financial life. This is not a personal vendetta. The lender is trying to make sure that you are able to repay the loan you’re asking for. With the changes in the underwriting requirements that occurred in the beginning of 2014, lenders are cautiously moving forward. Buyers can help themselves by having income and expense documentation easily accessible. Get your copies of your tax returns in order so when you’re ready to hit the gas, you aren’t stalled by missing paperwork. Most lenders will give a buyer a checklist early on to make sure that the majority of the documentation is received in one package; don’t procrastinate. It may be the difference in getting the home you love or missing out because you aren’t ready with your lenders approval letter. Every indication is telling us the market is heating up, buyers have excellent opportunities as well as incentive. Make the most of this market by finding a lender, Realtor and a home that will work for you!

I am an Associate Broker with Teton Valley Realty. I have been a licensed REALTOR® for twelve years and actively involved with property sales and development in Teton Valley.

I have lived in Teton Valley for over 20 years and feel fortunate to have made a home here with my husband, Travis, and two children, Conley and Arah.

I am an Associate Broker with Teton Valley Realty. I have been a licensed REALTOR® for twelve years and actively involved with property sales and development in Teton Valley.

I have lived in Teton Valley for over 20 years and feel fortunate to have made a home here with my husband, Travis, and two children, Conley and Arah.